NESTEGG Building Portfolio:

To my Fellow Investors:

The stock portfolio below began August 30th, 2013. And though you might be experienced in owning individual stocks, I urge you to call or email me for a consultation. My hope is that you consult with me to help you build YOUR OWN portfolio, designed to you specifically. This portfolio is simply to demonstrate my expertise and knowledge and is NOT intended for you as an individual since all investors have different risk tolerances and time horizons. But it provides a sense of my approach to investing and can help you decide if I am the appropriate Advisor for you.

This portfolio consists of a few of the best companies that I found 2 and a half years ago that have great products and services that I believe consumers and businesses will continue to buy in good times and bad. Most of these companies have paid solid dividends during that time and are ones that I expect to raise those dividends over time. Most will have a long history of paying dividends as well, but not all. On occasion, I will also add a riskier growth company to the portfolio in an attempt to quickly score a big gain and boost the rate of return. However, my objective is to collect dividends from these stocks, over and over and over again.

I will only sell a stock on occasion and add a new one to replace it. We will NEVER

sell in a panic! So go and live your life and check back to the portfolio once per week for my update and comments on the previous week! Allow me do the work and email me your comments – I really love this Stuff!

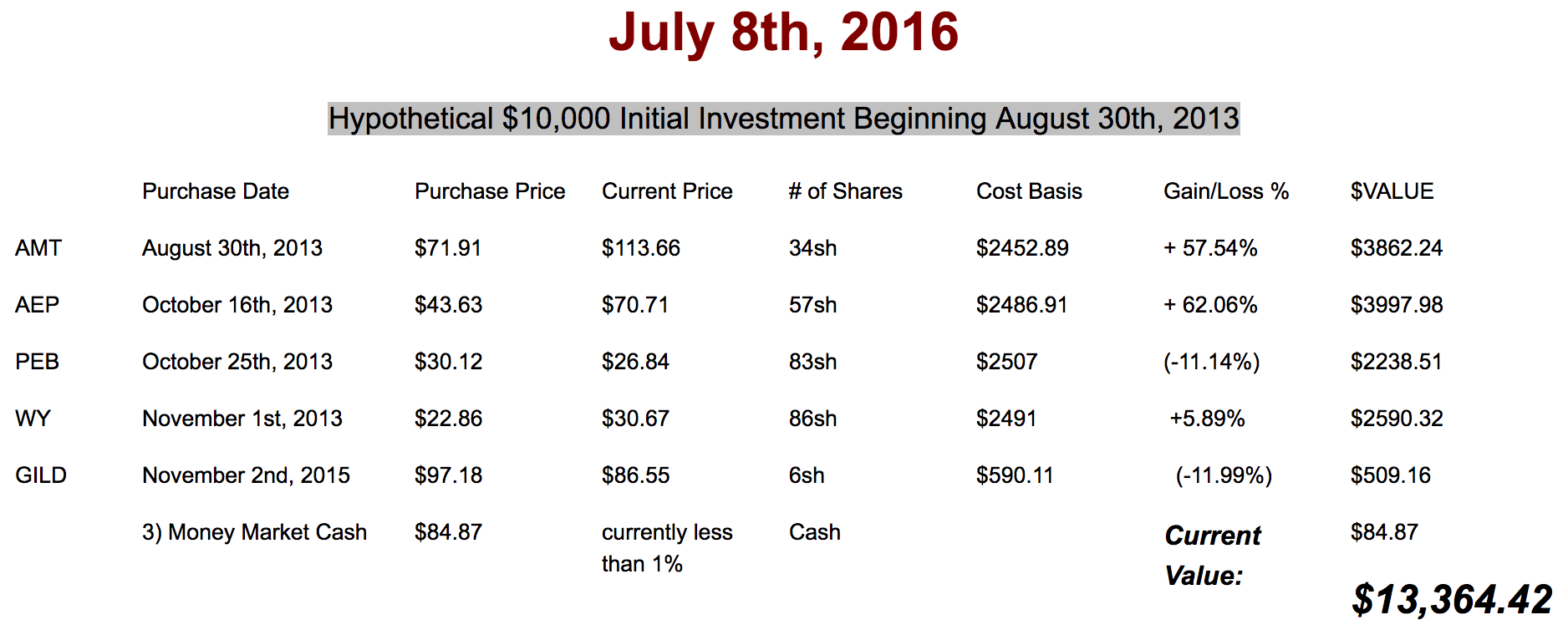

TOTAL PORTFOLIO GAIN/LOSS + 33.64% Since Inception 8/30/13

- Annual Percentage Gain/Loss 8/30/13 - 8/29/14 +21.35%

- Annual Percentage Gain/Loss 8/31/14 - 8/31/15 (-6.76%)

- Dividends Collected for 1st Year $229.80

- Dividends Collected for 2nd Year $356.50

- 9/10/15 AEP paid $.53/sh dividend or $30.21 in Cash to Money Mkt. Account

- 10/7/15 AMT paid $.46/sh dividend or $15.64 in Cash to Money Mkt. Account

- 10/15/15 PEB paid $.31/sh dividend or $25.73 in Cash to Money Mkt. Account

- 11/2/15 Bought 3 shares of a more aggressive stock. $7 commission paid.

- 11/30/15 PCL paid $.44/sh dividend or $23.76 in Cash to Money Mkt. Account

- 12/10/15 AEP paid $.56/sh dividend or $31.92 in Cash to Money Mkt. Account

- 12/30/15 Stock 5 pays $.43/sh dividend or $1.29 in Cash to Money Mkt.

- 1/13/16 AMT paid $.49/sh dividend or $16.66 in Cash to Money Mkt Account.

- 1/15/16 PEB paid $.31/sh dividend or $25.73 in Cash to Money Mkt Account.

- 2/19/16 Plum Creek Timber acquired by Weyerhauser. PCL shareholders get... 1.6 shares of WY for every share of PCL.

- 3/10/16 AEP paid $.56/sh dividend or $31.92 to Money Mkt Account.

- 3/18/16 WY paid $.31/sh dividend or $26.66 to Money Mkt Account.

- 3/30/16 GILD paid $.43/sh dividend or $1.29 to Money Mkt Account

- 4/12/16 AMT paid $.51/sh dividend or $17.34 to Money Mkt Account

- 4/15/16 PEB paid $.38/sh dividend or $31.54 to Money Mkt Account

- 5/6/16 Bought 3 more shares of GILD at $84.68/share.

- 6/10/16 AEP paid $.56/sh dividend or $31.92 to Money Mkt. Account

- 6/24/16 WY paid $.31/sh dividend or $26.66 to Money Mkt Account

- 6/29/16 GILD paid $.47/sh dividend or $2.62 cash added to MMKT.

Build a Nestegg for your Financial Freedom!

My company provides educational insight into common stock are and how they work to customers in Middleton, Massachusetts

and beyond. I cover new and interesting topics on a weekly basis.

Financial Insight

Do you fully understand what you are buying when you own stock in a public company? Learn all these things and more through my website's weekly educational Insight/Education page.

Contact

us today with additional questions regarding stocks and more!